In addition to the main points above, I would also like to point out another crucial part of Darvas’ success. Standing aside is a position just as being long or being short are.Don’t be afraid to stand aside (no money invested).Know in what market conditions your strategies work well and more importantly, not so well.Monitor the performance of your trading and when things aren’t quite working out as expected then maybe market conditions are changing.

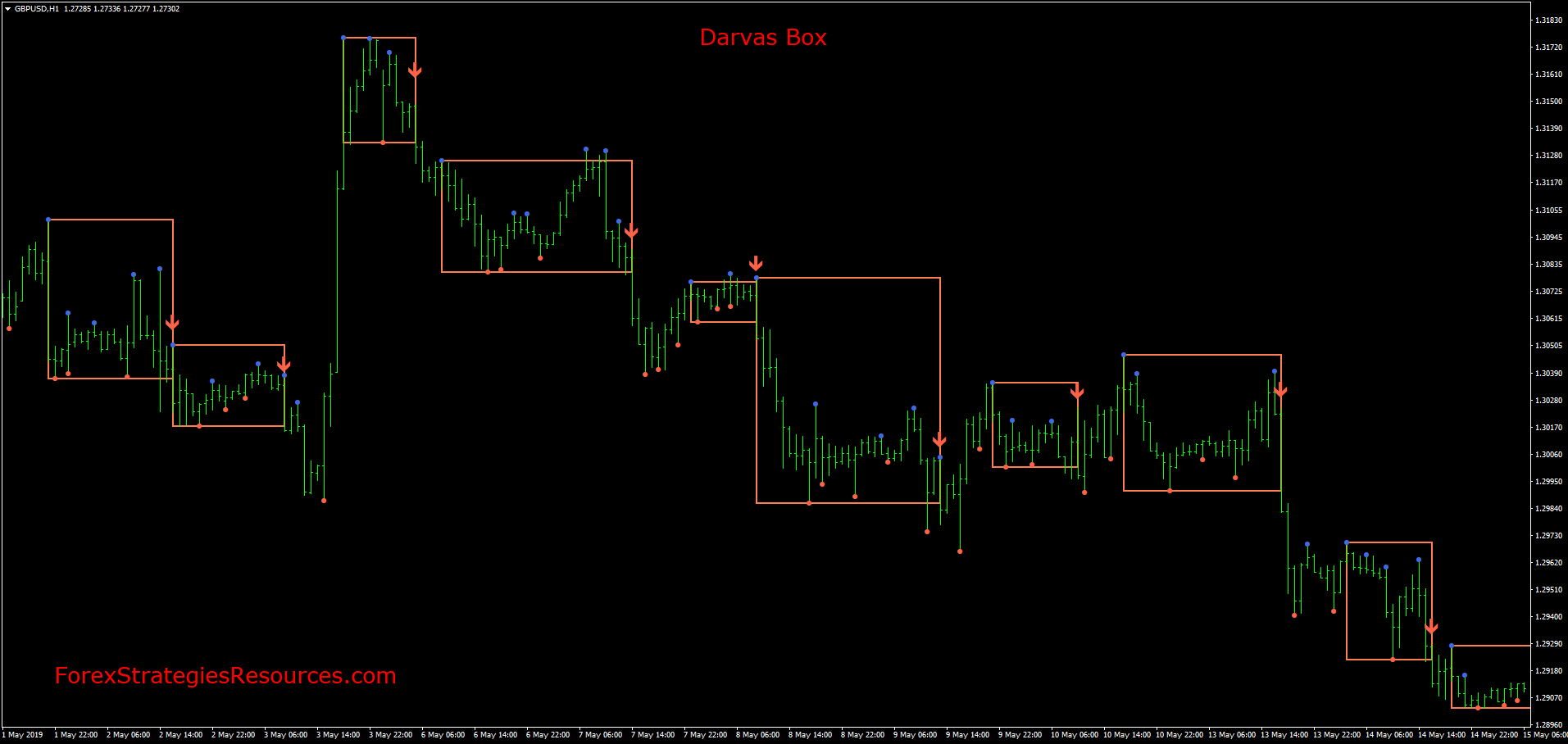

While he found it impossible to recognise this turning point in the market at the time, sticking closely to the rules of his theory did a pretty good job at signalling the market change.īy standing aside or sitting on the sidelines with no money invested, Darvas saved himself from what could have been a massive loss to his account during the beginning of the Bear Market in which the majority of investors lost money spectacularly.īy sharing this part of Darvas’ story with you there can be lessons to be learnt: He didn’t realise at the time but that period of small losses and lack of trading opportunity was the end of the great Bull Market. He spent a matter of weeks without any positions while he just watched the markets, waiting until the stronger stocks started to behave in a manor in which he could buy and profit from them. But after that string of losses he could not now find any potential trades to make. This was an unusual position for him to be in. He was taking trades according to his rules but the stocks just weren’t behaving as they had in the past.īy August of 1957 Darvas found himself in the position of owning zero stocks. These results were not in line with his normal performance. However in the summer of 1957 he made a string of trades according to his theory and saw every one turn into a small loss. So over the years Darvas had developed a very profitable strategy to trade stocks. Very impressive today but much more so for him over 50 years ago! This “box theory” lead him to making his fortune of over $2,000,000. He would not be influenced by any fundamental information or listen to any rumours. A favourite of mine and a recommended read is that of Nicolas Darvas.ĭarvas traded stocks and developed a theory or strategy which was based purely on price action. Including ones on theory, strategy, psychology, position sizing but also real accounts of real traders. Should volatility start to decrease within the next few weeks the I will begin to trade and test this new strategy.

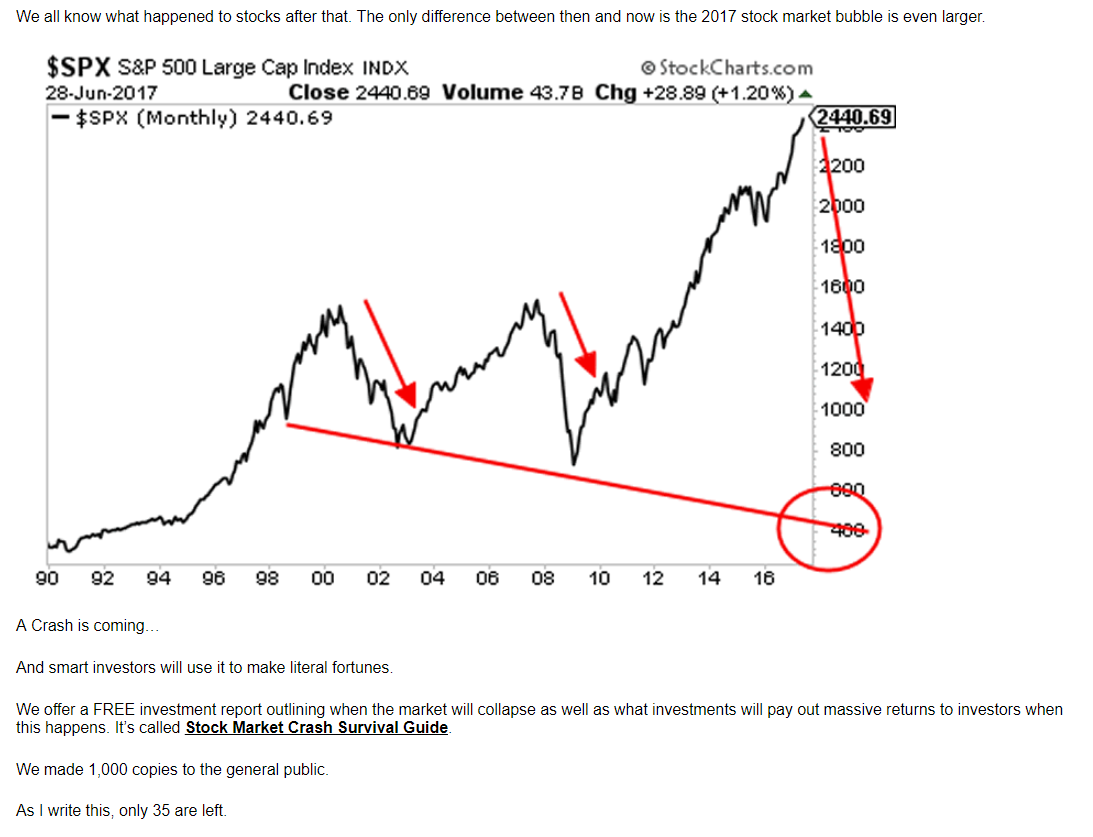

The Average True Range or the difference between the high and low of each day is a good measure of volatility and it is clear that it has been significantly increasing over the past few months. In fact, the most recent closing price is just a few points away from the closing price on January 2nd, the first trading day of the year. It performs better in quieter, trending markets.īy looking at the chart I have shared you can see that since the start of this year, the market has been moving in a sideways fashion. I understand the mechanics of how this strategy works and I also know form experience that this type of strategy doesn’t work well in Choppy Volatile markets. I have stated many times that certain strategies work best (and worst) in certain market types. The reason is the main market conditions are not right. However, it has been nearly 6 weeks and I have not taken a trade using this strategy yet. I am ready to start testing RS27 in realtime. I have recently designed a new Short Selling strategy for stocks.

0 kommentar(er)

0 kommentar(er)